As I Bike TO readers plumb the minds of suburbanites to find out why they continue to buy houses in the suburbs, they may be interested in this study by the Brookings Institute which has created an index map of housing + transportation affordability and correlated it to an index of local median wages to show locations of affordability. As it turns out, living in the suburbs doesn't look quite as appealing when we take into account the transportation costs.

As I Bike TO readers plumb the minds of suburbanites to find out why they continue to buy houses in the suburbs, they may be interested in this study by the Brookings Institute which has created an index map of housing + transportation affordability and correlated it to an index of local median wages to show locations of affordability. As it turns out, living in the suburbs doesn't look quite as appealing when we take into account the transportation costs.

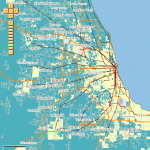

In this example map of Chicago you can see the "affordable" yellow areas where housing + transportation are within 0 to 45 % of median income and the blue are above. The results rub our assumptions the wrong way: living in the suburbs is often not that cheap. It just so happens that it's a lot easier to calculate our total housing costs than total transportation costs.

The site says:

"The Housing + Transportation Affordability Index, developed by CNT and its collaborative partners, the Center for Transit Oriented Development (CTOD), is an innovative tool that measures the true affordability of housing. Planners, lenders, and most consumers traditionally measure housing affordability as 30 percent or less of income. The Housing + Transportation Affordability Index, in contrast, takes into account not just the cost of housing, but also the intrinsic value of place, as quantified through transportation costs."

Comments

Peter (not verified)

Drive until you qualify....

Sat, 04/26/2008 - 12:12That's all that matters.

Affordability after the fact is a secondary concern for someone who wants to own a house.

I say we push for housing developments that don't have car parking. That'll bring down the price. The compactness will hopefully bring down the price. Neighbors won't be opposed because they won't be any new car traffic. Businesses will dig it. Etc.

Darren_S

Driving is fun?!

Sat, 04/26/2008 - 23:03The Star ran a story last summer on why people suffer long commutes. While cheaper housing was on the list, most also said they enjoyed the solitary time they get in their cars. The time between the office politics at work and the screaming kids at home.

Dr. Steph

That's why I ride

Mon, 04/28/2008 - 12:47I ride my bike for the same reason. It clears my head and gives me a bit of time for myself between work and the day care.

And when I pick up my kids (who bike too) we get a nice ride home and they burn off a bit more steam and we usually have a good evening together.

Annie (not verified)

I bet they didn't factor in

Mon, 04/28/2008 - 10:14I bet they didn't factor in the cost of necessary renovations when they calculated their housing affordability index... When we bought our house 11 years ago, everything in it leaked (plumbing, roof, the gas furnace...)! There was peeling lead-based paint in what was supposed to be the kids' room. Transportation time? How about time spent on weekend reno projects? I don't regret our decision to buy in the city, just pointing out that these studies oversimplify the issues and overlook important factors that influence the decisions people make. I stand by my original comment in the other thread - a greater variety of affordable options for young families will encourage more people to buy in the city.

Tone (not verified)

Re: I bet they didn't factor in

Mon, 04/28/2008 - 14:08I've lived in the city for over a decade now, and have owned a home for nearly five years.

My own experience also doesn't really bear out the results of these studies ... but like many things, I'm sure it depends what you are comparing.

For me .. I have no interest in spending $10,000 per year simply to get to work. So, if I move out of the city, it will near a GO line. It's bad enough to spend a significant amount of time commuting. At least on the GO, I can read or watch videos on my iPod.

And, even living in the city (Jane and St. Clair area), we still have one car ... and that's not likely to change, either.

And, comparing homes out of the city with their rough equivilents in the city (size, neighbourhood, etc.) the difference in price is vast. I can find many houses in my price range near the GO station in Burlington with three or even four bedrooms, in nice neighbourhoods. I cannot find anything comparable for even a similar price anywhere close to downtown.

The only things I have seen that are even close are in Alderwood or in the west Lakeshore area (which are also under consideration) ... but most still either require a fair bit of work, aren't really comparable in size (and with a growing family, we've already outgrown our two-bedroom bungalow and don't want to quickly outgrow the next house). When I look at more "apples to apples" comparisons to the houses I've seen in Burlington ... the difference in price is a lot closer to $100,000 (or more) ... a signifianct amount and enough to mean I will not qualify for a mortgage for that kind of house in Toronto.

I do recognize that the long term potential for real estate prices in Toronto is probably better than outside of the city ... making it a better investment ... but that's irrelevant if one cannot actually afford to buy the house in the first place!

There seems to be a notion in a lot of the comments I see here that everyone should live in a house in Toronto. The reality is that isn't a simple or straightforward option for some of us. For those of us who didn't buy into the Annex or Bloor West Village for example, when they were still affordable, the options are now a bit thinner. My goal is to make the options I do have work as well as possible.

bwinton

I have no idea what your

Tue, 04/29/2008 - 15:20I have no idea what your price range is (or what you think it is), but my wife and I found that with the money we save (in insurance, gas, and lease payments) by not owning a car we could afford a far more expensive house than we originally thought. An extra $100,000, paid off over 25 years, only works out to $4,000/year, which was less than my car insurance was the last time I was insured.

Is our house smaller than what we could get in the suburbs? Yes, no doubt about it. But it's big enough for us and our two daughters, and that's one of the trade-offs we decided to make.

I guess I don't think that everyone should live in a house in the city, but (as seems to be the point of the story) I don't think people are counting the true costs of living in the suburbs, and are seeing it as being $100,000 cheaper, when it's really far less of a difference. (And as gas prices go up, it could conceivably end up being more expensive, if it isn't already.)

AnnieD

Interest rate?

Wed, 04/30/2008 - 08:32That extra 100K only works out to $4,000/year at 0% interest. With a 5-year closed mortgage at 5.54% interest, you'd be paying an extra $7352/year ($612.72/month). Not sure where you were getting your car insurance, but ours is $1400/year, not over $4000!!! Not that it matters, since Tone said he would have a car either way and would use GO transit, at $252/month for a pass. Only starts looking comparable if his partner will also be taking the GO to Toronto. Gas prices will go up, but chances are, so will mortgage interest rates. Bad to take on too much debt.

Tone (not verified)

The mortgage issue

Thu, 05/01/2008 - 10:39bwinton said: "...my wife and I found that with the money we save (in insurance, gas, and lease payments) by not owning a car we could afford a far more expensive house than we originally thought. An extra $100,000, paid off over 25 years, only works out to $4,000/year, which was less than my car insurance was the last time I was insured."

Question: did the fact that you didn't own a car (and have that associated cost) impact what size mortgage you lender was willing to offer?

From what I've experienced, what kind of mortgage you qualify for has more to do with your gross earnings (and the benchmark that housing should not exceed about a third of your household gross earnings). Significant other debt seems to make an impact (say, two big car loans), but if you already own your car (which we do) ... getting rid of it (and the associated costs) does not seem to have any impact on the size of mortgage one would qualify for.

For me, that's a significant issue. If I cannot qualify for (and manage) an extra $100,000 mortgage, I cannot buy the more expensive city home. All of the other accounting is academic.

Has anyone found that reducing household costs (for example, by going car-free) made a significant difference in the size of the mortgage they qualified for?

bwinton

The Mortgage Issue.

Mon, 05/05/2008 - 13:23AnnieD said:

The last time I was insured, I was an 18-24 year-old male, and it was quite a few years ago. Apparently they're expensive to insure. My younger sister, on the other hand, cost my parents almost nothing to insure.

and:

I'm betting gas prices will go up more than interest rates. Certainly over the long term. (Of course, in the long term, perhaps the suburbs will emerge as small cities in their own right, and reduce their resident's need for cars. One can only hope.)

and also:

Sing it, sister! This is a completely different rant, but the amount of extra debt people seem willing to take on continually shocks me.

Tone said:

I expect so. One of the questions was how much debt do we have, and not having a car lease meant that we could support that much more mortgage debt. (Having said that, I didn't ask, and have no real data, just guesses. :)

If you already own your car, then I can't see it having much effect. (Although in my ideal dream world, it would, since you don't have to maintain something you don't own, and they would take that into account. I'm sure they don't, however.)

Tone also said:

Very true. Kind of beside my point, but very true.